News

IRS Apologizes for CP14 Error

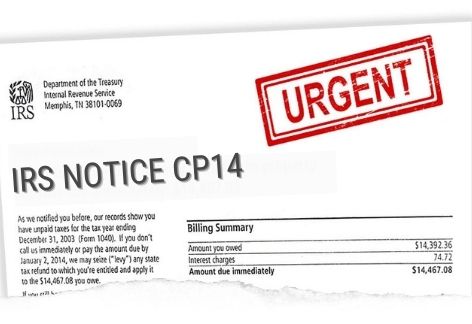

The IRS recently tweeted an apology to taxpayers who may have received erroneous CP14 notices. These CP14 letters are generated and sent automatically when a taxpayer has a balance due, indicating that the taxpayer must remit within 21 days.

The IRS has clarified that California taxpayers covered by disaster declarations still have an automatic extension until October 16th (August 15 for Modoc and Shasta counties) to file returns, pay taxes owed, and make certain estimated tax payments. Taxpayers who received the CP14 in error do not need to contact (or have their certified tax professional contact) the IRS.

Have questions or need assistance? The qualified tax professionals at PP&Co are ready to help. Contact us at info@ppandco.com or (408) 287-7911 to discuss your specific situation.