Insights

UPDATE: Tax Relief for California Storm Victims

UPDATED MARCH 3RD

UPDATED MARCH 3RD

The Internal Revenue Service (IRS) and California Franchise Tax Board (FTB) recently extended the tax filing deadline to October 16, 2023 for those who live or have a business in designated disaster areas. As a result, those individuals and businesses will now have until October 16, 2023 to file various individual and business tax returns and to make tax payments.

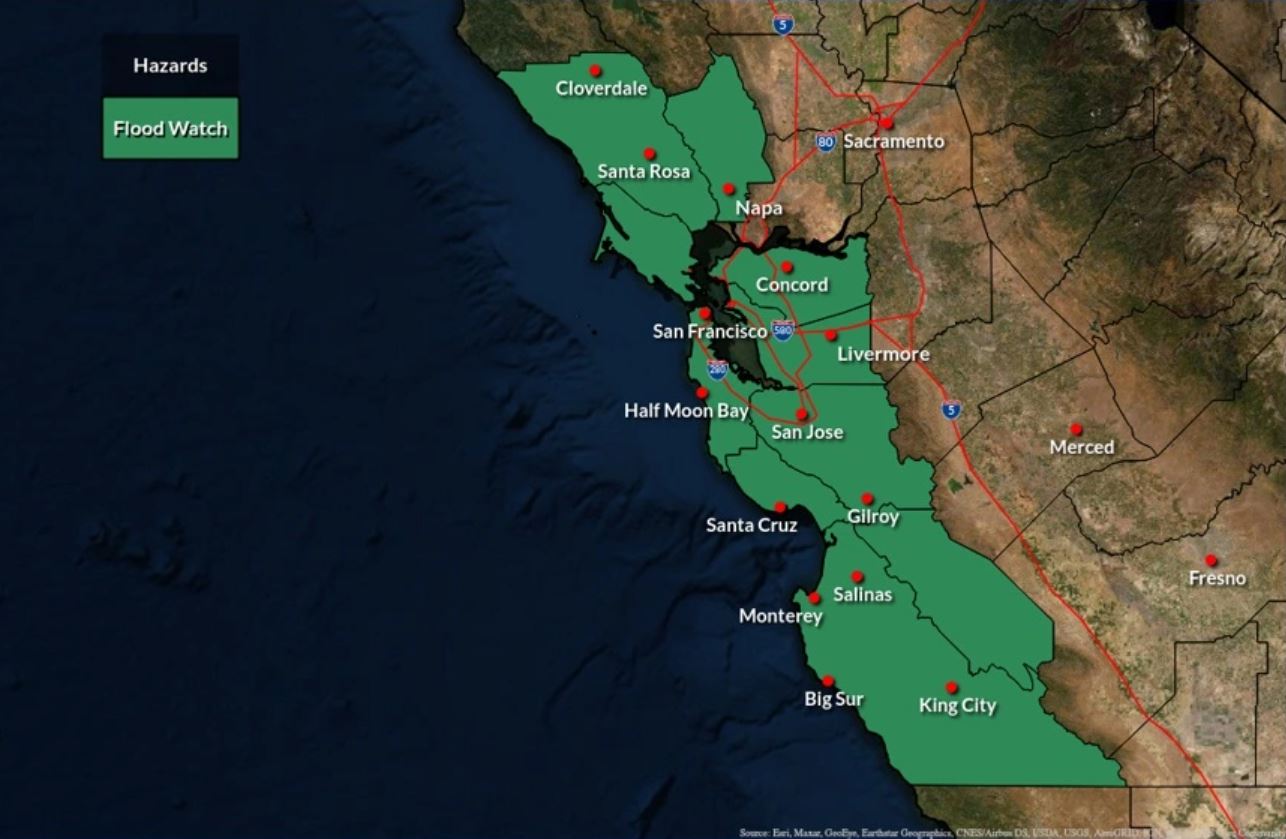

Disaster Areas

The relief is available to individuals and businesses located in the following counties: Alameda, Colusa, Contra Costa, El Dorado, Fresno, Glenn, Humboldt, Kings, Lake, Los Angeles, Madera, Marin, Mariposa, Mendocino, Merced, Mono, Monterey, Napa, Orange, Placer, Riverside, Sacramento, San Benito, San Bernardino, San Diego, San Francisco, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Solano, Sonoma, Stanislaus, Sutter, Tehama, Tulare, Ventura, Yolo, and Yuba.

Automatic Relief

Taxpayers do not need to contact the IRS or FTB to receive relief as it is automatically provided to any taxpayer with an address of record located in the disaster areas. Taxpayers who live or have a business outside a disaster area, but whose tax records are in a disaster area, should contact the IRS at (866) 562-5227 to request relief .

Federal Tax Filing Relief

The IRS and FTB give affected taxpayers until October 16, 2023, to file most tax returns (including individual, corporate, and estate and trust income tax returns; partnership returns, S corporation returns, and trust returns; estate, gift, and generation-skipping transfer tax returns; annual information returns of tax-exempt organizations) that have either an original or extended due date occurring on or after January 8, 2023, and before October 16, 2023.

Federal Tax Payment Relief

Federal and California tax payments that were originally due during the period beginning January 8, 2023 and ending April 18, 2023, have been extended until October 16, 2023.

Please note that this automatic extension also applies to quarterly payroll tax returns that are normally due before October 16, 2023, and any federal and California estimated tax payments due before this date as well. This relief includes 4th quarter 2022 estimates due January 17, 2023, 1st quarter 2023 estimates due April 18, 2023, 2nd quarter 2023 estimates due June 15, 2023, and 3rd quarter 2023 estimates due September 15, 2023. The relief also applies to California Pass-Through Entity Elective Tax payments due June 15, 2023.

Taxpayers who are eligible to contribute to an Individual Retirement Account (IRA) or Health Savings Account (HSA), now have until October 16, 2023 to make those contributions.

We will continue to provide information as it becomes available. In the meantime, contact the experienced tax advisors at PP&Co at info@ppandco.com or by calling (408) 287-7911 for assistance with your specific situation.