News

2020 Tax Filing Deadline(s) and Shelter in Place Order

We realize that taxpayers have been anxiously awaiting news regarding the extension to file tax returns announced by the President last week. As of March 16th, here is what we know.

We realize that taxpayers have been anxiously awaiting news regarding the extension to file tax returns announced by the President last week. As of March 16th, here is what we know.

On March 11th, the Treasury Secretary, Steven Mnuchin said the IRS would delay the April 15th tax deadline for most taxpayers. As of today, March 16th, the IRS has not announced any official guidance or details regarding the April 15th deadline. We will continue to monitor any announcements, but we are expecting that guidance will be announced shortly.

On March 12th Governor Gavin Newsome announced Executive Order N-25-20 granting a 60-day extension of time to file California tax returns and pay taxes for individuals and businesses. On Friday, March 13th the California Franchise Tax Board (FTB) released a statement indicating that taxpayers affected by the COVID-19 pandemic are granted an extension to file tax returns and tax payments until June 15th, including partnerships and LLCs taxed as partnerships due on March 15th (a 90-day extension), individual tax returns due on April 15th, and estimated tax payments due on April 15th. The FTB has further clarified that the Executive Order includes any business entity with a California return or tax payment due between March 15th and June 15th, including S-corporations, corporations, and any other entity types with returns due during this period.

In addition to the FTB filings and tax payment extensions, the California Department of Tax and Fee Administration (CDTFA) stated that taxpayers may request assistance by contacting the CDTFA. Sales and use taxes are among the various filings and payments made with the CDTFA. Such assistance “includes granting extensions for filing returns and making payments, relief from interest and penalties, and filing a claim for refund.” This can be done through the CDTFA’s online services, by mail, or email. Taxpayers can also contact the CDTFA’s Customer Service Center at 800-400-7115.

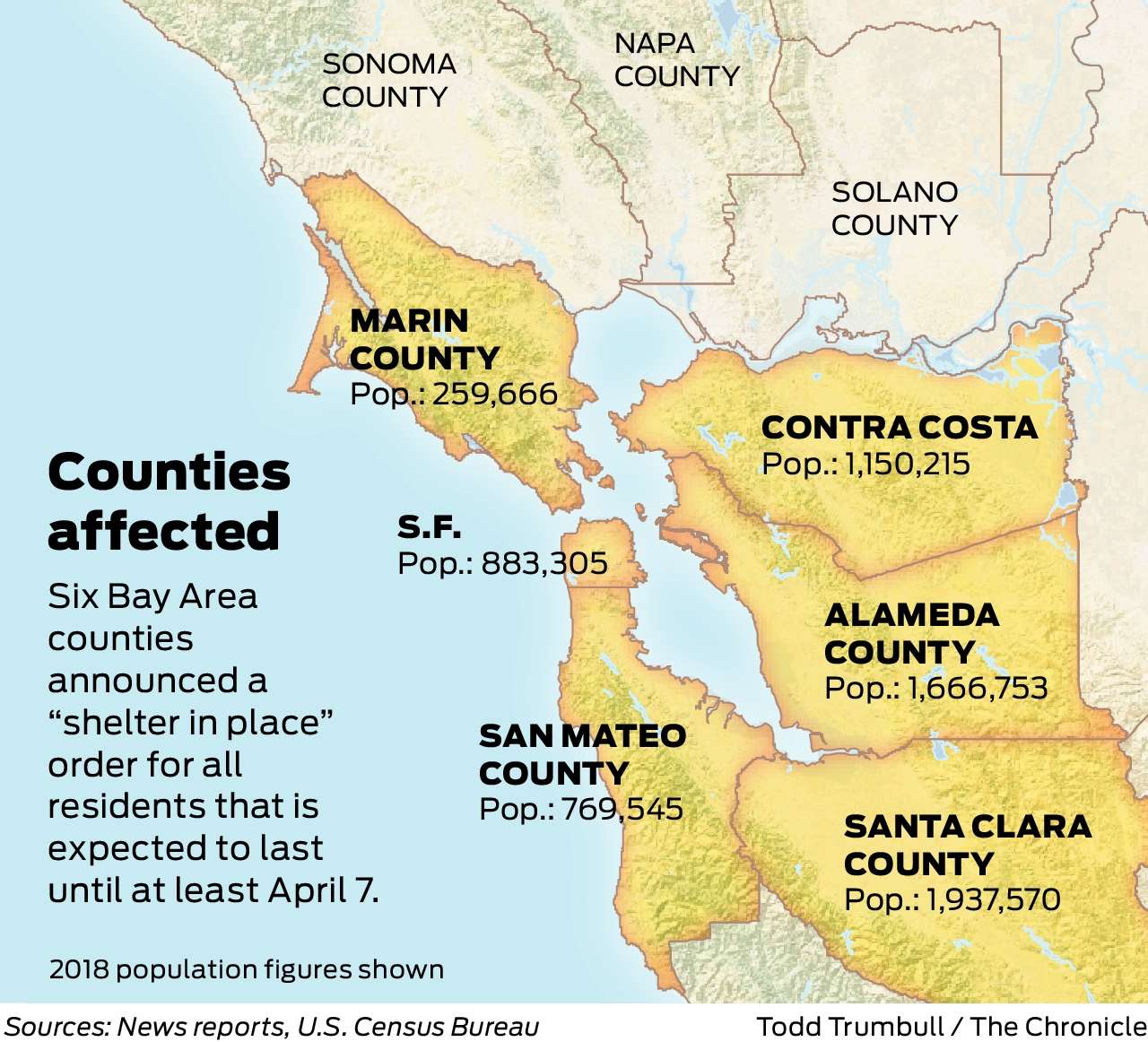

On March 16th the six Bay Area counties, including Santa Clara County, announced a “shelter in place” order (the Order) for all residents effective 12:01 a.m., Tuesday, March 17th, which will last until at least April 7th. The Order exempts Essential Businesses, which includes certified public accounting firms.

As a result, PP&Co will remain open during the Order and continue to provide professional services. For the safety of our employees, our professional staff will work remotely during the Order. As we noted last week, we ask that clients send any documents electronically via secure email or by mail to our office, and schedule a phone call, Skype, or Zoom video call. Because of the Order, there will be restricted access to our San Jose office. Clients should contact our office should they need to drop off information or pick up documents, so that we can make arrangements to accommodate that. While our face-to-face interactions may be limited, we will do our best to meet the needs and expectations of our clients and to deliver tax returns or other professional services in a timely fashion.

During these challenging times, we want to assure you that we are here and committed to meeting your needs. Please do not hesitate to contact us with any questions on the potential impact of these changes. Until this situation has been satisfactorily resolved, we appreciate your patience and hope that you and those close to you are, and will remain, well and in good health. Be safe and be well

Sincerely,

Petrinovich Pugh & Company, LLP