Insights

Tax Relief in California 2022-2023 Budget Bills

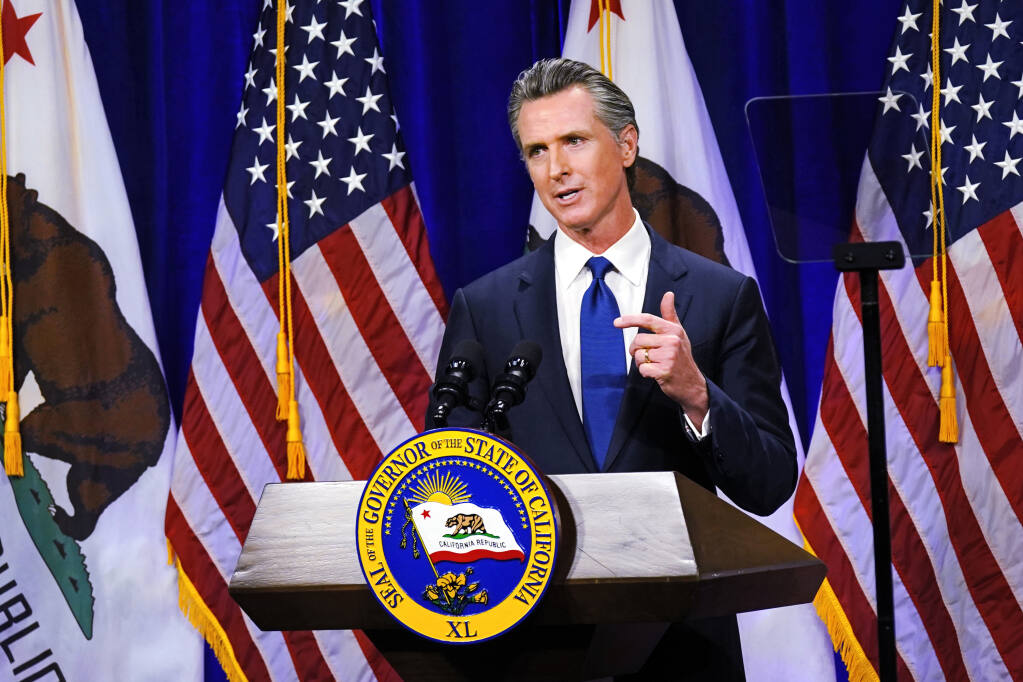

California Assembly Bills “AB” 192, 194 and 195 were signed into law by Governor Gavin Newsom on July 5, 2022. Here we outline tax-related highlights of the three bills.

AB 192 provides monetary relief in the form of a one-time tax refund payment to qualified California taxpayers. Taxpayers must meet the following conditions to qualify:

- Must have filed their 2020 California individual tax returns by October 15, 2021;

- Must be a California resident on the date payment is issued;

- Must have been a California resident for 6 months or more between January 1, 2020 and December 31, 2020;

- Cannot be claimed as a dependent by another taxpayer.

Each qualifying taxpayer may receive up to $700 for single-filers with California Adjusted Gross Income (AGI) of up to $250,000 ($500,000 if Head of Household); and up to $1,050 for those who are married and filing jointly with California AGI of up to $500,000. Qualified recipients may look forward to receiving these payments around the end of October.

AB 194 provides several tax-related provisions, including the following:

- Extends non-taxable loan forgiveness treatment to Paycheck Protection Program (PPP) loans approved after March 2021. Such forgiveness was previously taxable under California law. Affected taxpayers should consider filing amended returns.

- Grants a once in a lifetime abatement of a failure-to-file or failure-to-pay timeliness penalty for qualified taxpayers for taxable years beginning on or after January 1, 2022. Qualified taxpayers must have filed all returns and have paid all tax liabilities as of the date of the request for abatement.

- Lifts diesel fuel taxes levied on the gross receipts from the sale of, and the storage, use, or other consumption of diesel fuel, between October 1, 2022 to October 1, 2023.

- Allows the 2020 and 2021 Main Street Small Business Tax Credits I & II to be claimed on amended returns. The Main Street Small Business Tax Credit refers to the tentative credit reservation that is provided to small businesses who have a net increase in qualified employees and that experienced a 20% or more decrease in revenues between 2019 & 2020.

- Extends the California Competes Tax Credits by 5 years, through the 2027-2028 fiscal year. The credit is offered to incentivize businesses that i) want to come to California, and ii) stay and grow in California. To qualify for this tax credit, businesses are required to have a 5-year agreement with the Governor’s Office of Business and Economic Development (GO-Biz) that would establish milestone goals (e.g. full-time employment, salary level, and project investment) to be met on a yearly basis.

AB 195 solely focused on the Cannabis industry and introduced some new regulations and controls to the industry. On the tax side, this bill:

- Suspends the cannabis cultivation tax requirement outlining that the distributor collect the cannabis excise tax from the cannabis retailer as of January 1, 2023.

- Rather, the cannabis retailer would collect the cannabis excise tax from the cannabis purchaser to be remitted to the California Department of Tax and Fee Administration (CDTFA) quarterly as of January 1, 2023.

- Introduces a new credit for years beginning on or after January 1, 2023 – January 1, 2028, which is based on 25% of qualified expenditures incurred by a qualified cannabis business, subject to limitations.

- Introduces a new $10,000 credit for years beginning on or after January 1, 2023 – January 1, 2028 to a qualified cannabis equity licensee that received approval under a fee waiver and deferral program from the Department of Cannabis Control.

Unanswered questions abound regarding these provisions. The tax experts at PP&Co can help provide clarity. Contact us at info@ppandco.com or (408) 287-7911 for assistance.