News

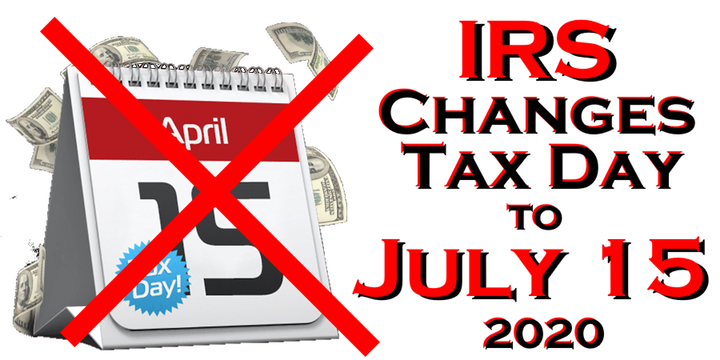

2020 Tax Filing and Payment Deadline Update

This is a rapidly evolving situation and we will endeavor to provide information and updates as they become available. As of the writing of this article (4.9.2020), according to IRS Notice 2020-23, here is what we know.

While the IRS had originally only extended returns and payments due on April 15th, they have now extended additional key tax deadlines, which expands relief to additional returns, tax payments, and other actions.

- Tax returns and tax payments extended to July 15th

- This generally now applies to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020.

- Tax payments include Federal income tax payments, including Self Employment Taxes

- No extension forms are required on April 15th

- No extension for the payment or deposit of any other type of federal tax or for the filing of any Federal information return is required

The California Franchise Tax Board (FTB) has also indicated that taxpayers affected by the COVID-19 pandemic are granted an extension to file tax returns and make tax payments until July 15th, including partnerships and LLCs taxed as partnerships due on March 15th, individual tax returns due on April 15th, and first and second quarter estimated tax payments. The FTB has further clarified that the Executive Order includes any business entity with a California return or tax payment due between March 15th and June 15th, including S-corporations, corporations, and any other entity types with returns due during this period (click HERE for details).

In addition to the FTB filings and tax payment extensions, the California Department of Tax and Fee Administration (CDTFA) stated that taxpayers may request assistance by contacting the CDTFA. Sales and use taxes are among the various filings and payments made with the CDTFA. Such assistance “includes granting extensions for filing returns and making payments, relief from interest and penalties, and filing a claim for refund.” This can be done through the CDTFA’s online services, by mail, or email. Taxpayers can also contact the CDTFA’s Customer Service Center at 800-400-7115.

There are also many other issues that need clarification and we will continue to monitor the situation and provide you with updates. Your PP&Co tax advisor will be working with you to determine how this impacts you, clarify any ambiguities, and work with you to ensure that your tax liabilities are paid timely.

We want to thank you for being a PP&Co client during these challenging times, and for your patience and cooperation as we navigate through the implications of COVID-19.

Please be assured that we are here and committed to serve you. If you have any questions on how these changes impact you, please do not hesitate to contact us.

Sincerely,

Petrinovich Pugh & Company, LLP